How are health insurance executives adapting their provider network strategies in a world where technology is rewriting the rules? For years, the healthcare industry has voiced concerns about unreliable and siloed data, hindering the efficiency of building, managing, and optimizing provider networks. Now, as digital transformation continues to accelerate, technologies such as advanced analytics, machine learning, and automation are reshaping decision-making processes across the industry and providing payers the chance to address long-standing challenges. While these innovations hold promise, operationalizing smarter, value-driven networks remains elusive. Many health plans still face barriers like poor data quality, limited analytical capabilities, and execution challenges.

To better understand how health plan leaders are navigating this transformation, we partnered with Becker’s Healthcare to survey executives who are leading these efforts.

The participants included 100 Directors, Vice Presidents, and C-suite leaders across national and regional health plans in Commercial, Marketplace, and Medicare Advantage sectors. Participants were responsible for provider network management, network performance, network adequacy, provider data accuracy compliance, network builds, and new market expansion. What they shared shed light on the priorities, obstacles, and opportunities influencing how executives engage with provider data and analytics to design, evaluate, and optimize their provider networks.

Live Insights from Becker’s 3rd Annual Payer Issues Roundtable

At Becker’s 3rd Annual Payer Issues Roundtable, Bob Tavernier, Sales Solutions Executive at Quest Analytics®, and Karen Tachian, Senior Director of Network Regulatory Operations at Health Care Service Corporation, explored insights derived from the study. Their discussion addressed how health plans can bridge the provider data quality gap, meet increasing regulatory requirements, and ensure meaningful member outcomes while keeping network design at the forefront of their strategies.

Top Priorities for Executives Shaping Provider Network Strategies

When asked about their top objectives for the next five years, participants identified four foundational initiatives.

1. Improve Member Satisfaction

2. Improve Clinical Quality

3. Drive Membership Growth in Existing Markets

4. Lower Administrative Costs

These priorities provide a framework for guiding resource allocation, influencing investment decisions, and driving strategic planning. While these goals establish a path forward, executing them requires a closer examination of the role provider network design plays in achieving them.

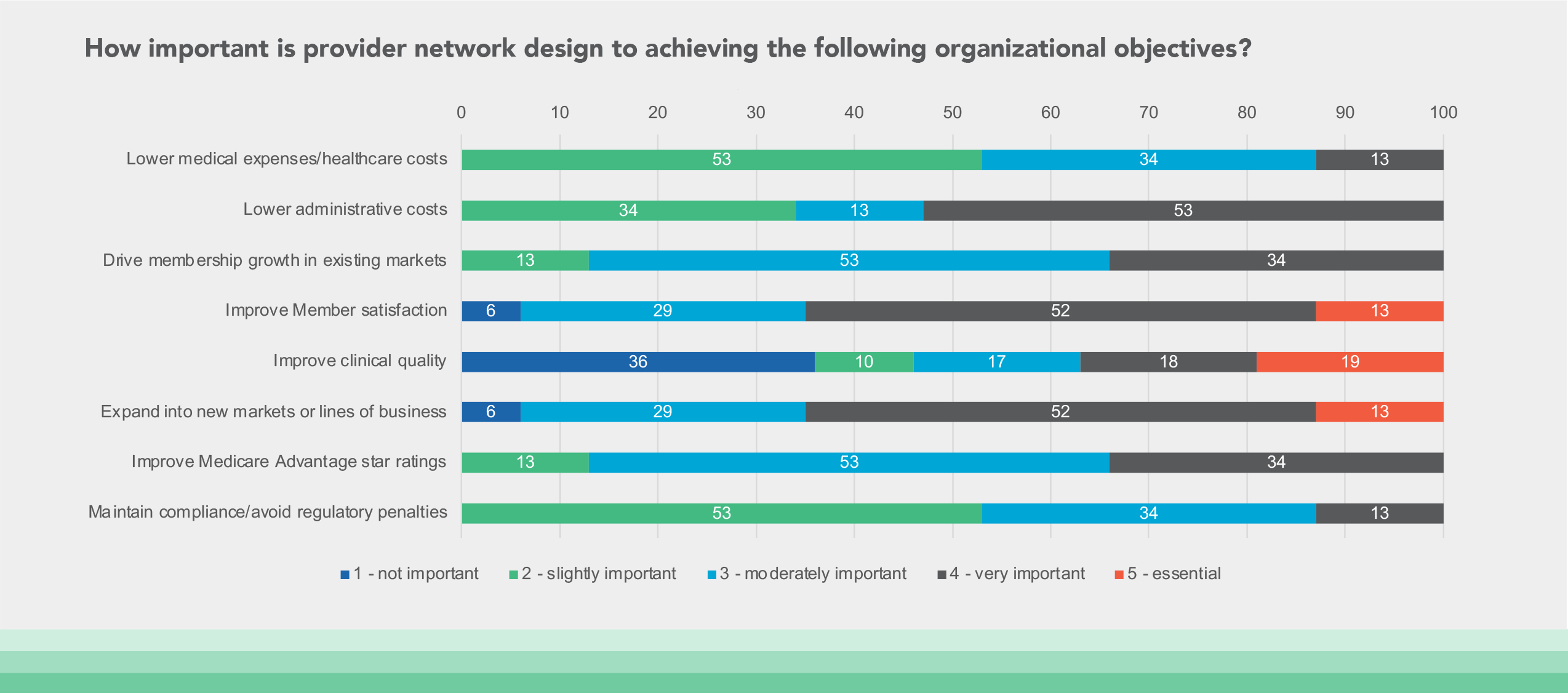

The Role of Provider Network Design in Driving Success

Participants evaluated the influence of provider network design on their organizational goals, reaching a strong consensus: network design has a direct impact on achieving these goals. Survey responses highlighted its importance in various top initiatives.

Improve Member Satisfaction: 65% of respondents said Network Design is “Essential” or “Very Important” to improve member satisfaction.

Expand into New Markets or Lines of Business: 65% of respondents rated Network Design as “Essential” or “Very Important” to expand into new markets or lines of business

Improve Clinical Quality: 37% of respondents ranked Network Design as “Essential” or “Very Important” to improve clinical quality.

Lower Administrative Costs: 53% of respondents ranked Network Design “Very Important” to reduce administrative costs.

Beyond these priorities, participants also attributed network design as a driver of other strategic goals, including Improve Medicare Advantage Star Ratings, Drive Membership Growth in Existing Markets, Lower Medical Expenses & Healthcare Costs, and Maintain Compliance & Avoid Regulatory Penalties.

These findings illustrate a widespread recognition that the architecture of a provider network can influence everything from care access to profitability. Tavernier elaborated on this point, stating, “In many ways, your provider network determines your outcomes, whether it’s care quality, member loyalty, or compliance. If the network isn’t designed well, achieving those outcomes becomes more difficult.”

Participants acknowledged the importance of having a proactive rather than reactive approach to provider network design, evaluation, and optimization. However, this shift requires addressing systemic challenges—none more significant than the effective use of data.

Data: The Backbone and Bottleneck of Network Optimization

Interestingly, when participants were asked to identify the data insights they consider critical for evaluating and optimizing provider networks — and whether they actively use those same data insights in their network analysis — the results revealed a gap between the value leaders attribute to specific data and their practical application of it. Several data insights were acknowledged as important but used less frequently than anticipated.

Competitor Network Composition: While 71% responded that this data is “Essential” or “Very Important,” only 40% actively use it when evaluating their networks.

Provider Cost and Utilization Efficiency: 65% said these insights are “Essential” or “Very Important,” yet only 23% reported using these insights in their network evaluations.

Member Access to Care: 53% viewed these insights as Very Important, and 53% incorporate them into their evaluations today.

Negotiated Rates for Competitors: 37% responded that this data is “Essential” or “Very Important,” yet 18% of respondents reported using this data in their network analysis.

Value-Based Care Readiness: 37% responded that this data is “Essential” or “Very Important,” yet 18% of respondents reported using this data in their network analysis.

What’s Driving the Data Gap?

This paradox raises the question: Why are these data insights not used, even though they are widely recognized as critical for network evaluation and optimization? Feedback from participants pointed to data quality as a key barrier to leveraging these insights. Many reported low confidence in the reliability of existing datasets. For example:

Provider Cost and Utilization Data: 42% of respondents rated the quality of this data as Poor.

Member Access-to-Care Data: 53% of respondents indicated that current datasets were of only Moderate quality.

Competitive Data: 0% of respondents considered their competitive data to be of High Quality.

The root causes of these issues lie in outdated verification processes and fragmented data infrastructures. Participants cited flaws in traditional approaches to provider data collection—such as manual provider verification or reliance on unvalidated web-sourced data. These methods allow inaccuracies to persist and remain a recurring concern tied directly to poor data management.

Tavernier explained the ripple effects of unreliable data across the healthcare ecosystem, stating, “When data isn’t dependable, it hinders every phase of the network lifecycle. Designing and optimizing networks becomes slower, more error-prone, and far less strategic. Without reliable data, organizations are essentially flying blind when it comes to building high-quality networks and delivering care pathways that drive better outcomes.”

Evolving Regulatory Requirements Amplify Data Accuracy Needs

Diving deeper into provider data integrity, the study highlighted how expanding regulatory requirements for provider directory accuracy are adding new layers of complexity to network design and optimization. One area of vulnerability for many health plans is the presence of ghost providers—individuals or entities listed in directories who are no longer active participants in a network.

Regulators are placing increasing emphasis on addressing ghost providers listed in directories and other plan marketing materials, particularly in the lead-up to Open Enrollment. To protect consumers and ensure that directory listings reflect active, practicing providers, some regulators are introducing additional data validation reporting requirements. These evolving requirements are designed to improve transparency and support informed decision-making for healthcare consumers shopping for healthcare options.

Interestingly, while survey participants expressed confidence in their capabilities to manage ghost providers, independent research conducted by Quest Analytics revealed a contrasting perspective. Findings show that more than two-thirds of networks studied exhibited ghost provider rates exceeding 9%, suggesting a potential blind spot for many health plans.

To resolve this challenge, solutions like Quest Enterprise Services® (QES®) Accuracy offer proactive provider attestation and targeted, actionable insights to help health plans identify and remove ghost providers. By prioritizing data integrity, plans can create directories that are both compliant and trusted by members.

Balancing Network Compliance with Marketability in Network Design

Participants emphasized that provider network design has evolved into a critical differentiator, requiring a careful balance between meeting regulatory network adequacy standards and creating member-centric, marketable networks. While regulatory compliance is essential, executives are increasingly recognizing the need to incorporate advanced data insights to offer networks that go beyond network adequacy and deliver competitive value.

One regional health plan executive shared, “At first, our focus was solely on meeting network adequacy requirements. However, we soon realized that compliance alone wasn’t enough to differentiate us in the market. To truly stand out, we needed a more comprehensive approach, one that integrated reliable data insights into our network analyses.”

Tavernier reinforced this perspective, stating, “Compliance keeps you in the game, but to compete and thrive, you need to exceed the baseline.” He acknowledged the challenges of achieving this balance while underscoring the importance of taking a holistic approach to data. According to Tavernier, integrating reliable data insights, such as provider utilization, provider quality metrics, and competitor analysis, is critical for achieving both compliance and differentiation. By leveraging these insights, health plans can create and refine networks that not only meet regulatory standards but also improve member experience, build loyalty, and drive long-term growth.

Building An Actionable Vision for Network Improvement

During the discussion on priorities and actionable steps, participants emphasized the significance of developing strategic roadmaps to guide progress. They suggested designing roadmaps that balance short-term goals, such as annual milestones and specific projects, with broader long-term objectives, typically spanning three to five years. By taking a flexible, adaptive approach, they found their data systems, workflows, and evaluation processes evolved cohesively, contributing more effectively to lasting success.

Tavernier highlighted the need for health plans to treat their networks as dynamic systems, explaining, “A provider network is never static, and neither are your members. Both are constantly evolving, and staying effective requires the ability to understand and adapt to those changes in real time. By focusing on practical, incremental steps, you can achieve meaningful progress that builds over time.” He reiterated this strategy, stating, “While you can’t solve every challenge at once, a structured, data-driven approach allows you to steadily enhance outcomes for your members and your organization.”

Looking Toward the Future of Provider Networks

Designing and optimizing networks is fast becoming a top priority in the shift toward member-centric care. The opportunities created by better data, advanced technology, and redefined strategies are setting the stage for a more connected and efficient industry.

Overcoming persistent barriers, such as data quality, system integration, and regulatory expectations, requires sustained effort alongside innovation. Yet for health plans that commit to addressing these challenges, the rewards are evident. Member satisfaction, cost efficiency, care quality, and regulatory alignment are all within reach for those willing to adapt their approach.

Tavernier’s final insight captures the promise of this transformation: “The future belongs to health plans that can connect all the dots: better data, smarter strategies, and more member-focused networks. When those elements work in harmony, the outcomes can be transformative.”

For any plan seeking growth and innovation, the path forward lies in infusing every level of provider network design with purpose and insight. By doing so, organizations will deliver both meaningful care and achieve lasting success in an ever-evolving healthcare landscape.

Know Your Data, Grow Your Business

Get a complimentary strategy session with a Quest Analytics expert to learn how we can help you maintain network adequacy, improve data accuracy and achieve astonishing efficiencies.